Gold price outlook: Analysts advise investors to spread out their gold purchases over the coming months instead of making a single large investment. They caution that the precious metal’s prices may experience significant pullbacks following the recent surge in price, despite the long-term bull market in gold remaining intact.

In the past month, gold prices have increased by 6.3% in dollar terms and 7.1% in rupee terms, while the Nifty has declined by 0.7%.Year-to-date, gold has gained 28.8% in dollar terms and 21.2% in rupee terms, outperforming the Nifty’s 15.3% gain.

Financial planners recommend that investors take a staggered approach when investing in gold, spreading their investments over the next 3-6 months. They suggest allocating 10% of portfolio assets to gold as a means of diversification.

“We expect gold to correct by 5-7% before the next leg up and a buy on dips is recommended,” Manav Modi, bullion analyst at Motilal Oswal Financial Services told ET.

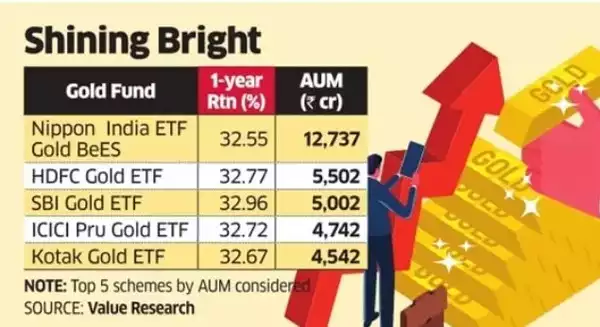

Gold Shining Bright

Vikram Dhawan, head commodities and fund manager at Nippon India Mutual Fund, warns that gold prices may remain volatile in the near term due to potential volatility in risk assets and a large open interest in COMEX. However, he notes that gold has historically performed well leading up to US elections, and the stakes are higher than ever for the upcoming election.

Also Read | PPF Calculator: How to become a crorepati with Public Provident Fund? Explained

Modi predicts that gold prices could reach rs 86,000 per 10 grams over the next two years, although there will be sharp fluctuations along the way.

He attributes the bullish long-term trend to escalating geopolitical tensions and expectations of further interest rate cuts by the US Federal Reserve.