The BSE sensex surged over 100 points to cross 85,000-mark for the first time.

Driving the news

- Both NSE Nifty 50 and S&P BSE Sensex have emerged as two of the best-performing stock indexes globally in 2024, trailing only the Nasdaq and S&P 500 in the US.

- The Nifty has surged 18.7% this year, while the Sensex has gained 17%, securing the third and fourth spots among major global stock markets.

- Analysts expect the rally to continue into 2025, bolstered by foreign inflows and favorable domestic economic conditions.

Why it matters

- India’s market rally highlights the country’s growing influence in the global financial landscape, particularly as it overtakes China in weightage within a key MSCI index for the first time.

- With India positioned as one of the world’s most expensive emerging markets, the sustained upward momentum could attract more foreign investment, further boosting economic growth and helping mitigate global risks, such as inflation or geopolitical tensions.

Zoom in

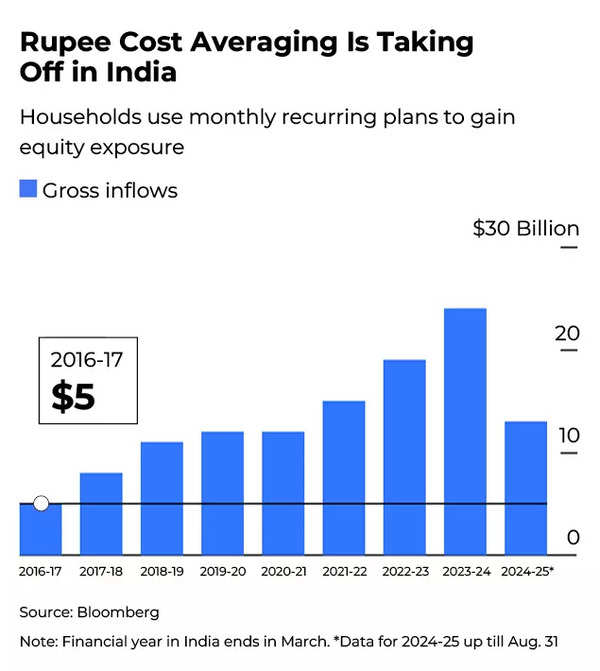

India’s rally is being driven by a combination of foreign portfolio inflows and domestic retail enthusiasm. Local investors, including retail and institutional buyers, have purchased a net $51 billion in shares this year alone. This has pushed the markets into overbought territory, raising concerns about unsustainably high inflows, especially from smaller cities where investors are increasingly directing their savings into mutual funds and equities.

Domestic institutional investors have net purchased 3.23 trillion rupees in 2024, with mutual fund contributions hitting record highs for 14 months straight. However, analysts at Jefferies caution that inflows of $7.5 billion per month from domestic sources are “unsustainably high.”

The hinterland awakens

From Indore to Sagar to Kota, there is a newfound enthusiasm for stocks. As per a Bloomberg report, this stock mania has become a nationwide phenomenon that has caught the attention of global financial powerhouses. Standard Chartered Plc, Barclays Plc, Axis Bank Ltd, and 360 One WAM Ltd are among the firms scrambling to establish a presence in India’s second-tier cities.

At the heart of this financial revolution are people like Mukesh Nagar, an electrician in Kota, a city of one million people. Since 2021, Nagar has been investing a quarter of his modest monthly income in a stock mutual fund. “There is no better option,” Nagar told Bloomberg, embodying the optimism that has gripped small-town investors. “The market will go up eventually.”

“If you look at the younger Indians 20 years ago, their first investment was a bank deposit,” Radhika Gupta, chief executive officer of Edelweiss Asset Management Ltd told Bloomberg. “Today, their first investment is through a monthly mutual fund plan.”

This optimism is backed by impressive numbers. The net wealth of Indian adults has grown at an 8.7% annual rate this century, nearly double the global pace. In smaller cities and towns, where the growth rate is even higher, much of this new wealth is finding its way into mutual funds. According to the Association of Mutual Funds in India, people living beyond the 30 largest metropolitan areas now hold about 12 trillion rupees ($143 billion) in mutual funds, a 200% increase from five years ago, the Bloomberg report said.

Dark side of the boom

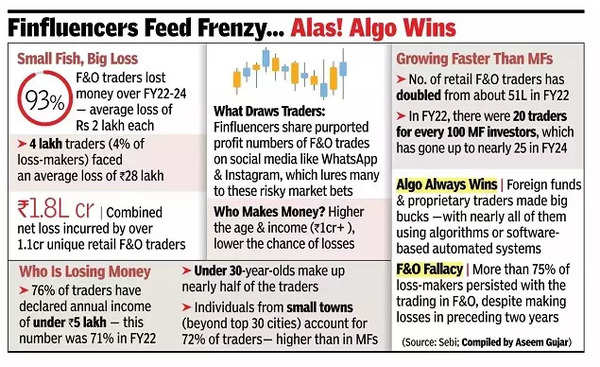

- While the stock market surge has brought unprecedented opportunities, it has also exposed the vulnerabilities of

retail investors , particularly in the high-risk futures and options (F&O) segment. A recent study by the Securities and Exchange Board of India (Semi) revealed a stark reality: 93 out of 100 retail traders in the F&O segment lost money between FY22-24, with an average loss of about Rs 2 lakh per person. - The study highlighted a concerning trend among young traders. Between FY23 and FY24, the proportion of F&O traders below 30 years increased significantly from 31% to 43%. Alarmingly, nearly 93% of these young traders incurred losses in F&O in FY24, higher than the average loss-makers of 91.1% in the same period.

- In contrast, proprietary traders and foreign portfolio investors (FPIs) reaped substantial profits, with algo traders dominating the gains. This disparity underscores the need for better financial education and regulatory oversight as India’s stock market mania continues to sweep through its hinterlands.

- This stock market mania has not gone unnoticed by regulators. Ashwani Bhatia, a member of the Securities & Exchange Board of India, expressed concern about the boom in small-scale IPOs, saying, “We are very, very worried.” This caution comes in the wake of a motorcycle dealership with just two stores and eight employees raising $1.4 million in a wildly oversubscribed offering.

What’s next

- As India’s stock market continues its ascent, bolstered by foreign inflows and favorable domestic policies, the country is entering uncharted territory. Financial powerhouses like Morgan Stanley are making bullish predictions, with analysts like Ridham Desai drawing parallels to the US 401(k) boom.

- Desai, Morgan Stanley’s leading India strategist, anticipates that the widespread enthusiasm for investing, which is currently sweeping through India’s rural areas, will have a profound impact on the country’s equity markets.

- According to Desai, this investment fervor could potentially surpass the influence that the introduction of retirement plans had on the US markets. He predicts that this phenomenon may persist for at least two decades, potentially leading to the most prolonged bull market run ever witnessed in India’s financial history.

- Radhika Gupta, CEO of Edelweiss Asset Management Ltd., encapsulates the broader transformation taking place: “If you look at the younger Indians 20 years ago, their first investment was a bank deposit. Today, their first investment is through a monthly mutual fund plan,”Gupta told Bloomberg.

- It’s a shift that reflects a deeper evolution in how Indians think about wealth—one that stretches far beyond Mumbai’s financial elite, into the very heart of the nation.

(With inputs from agencies)