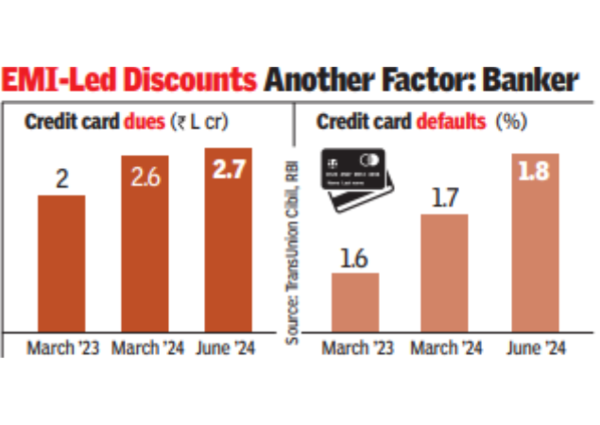

MUMBAI: Credit card dues have continued to rise steadily along with defaults – signalling growing borrower distress. Credit card defaults worsened to 1.8% as of June 2024 from 1.7% just six months ago and 1.6% as of March 2023, TransUnion Cibil data showed. While the percentage increase may seem marginal, the amount of outstanding credit card dues has increased significantly.

As of June 2024, credit card outstanding amounted to nearly Rs 2.7 lakh crore, up from Rs 2.6 lakh crore in March 2024 and a little over Rs 2 lakh crore in March 2023.Before the pandemic, in March 2019, total card outstanding stood at Rs 87,686 crore – representing a CAGR of 24% over the five-year period.

The trend is adding stress to the unsecured lending segment, which includes credit cards and personal loans, a Macquarie report said. “Young millennials are using the entire limit and directly defaulting and turning into an NPA without even revolving the loan,” Suresh Ganapathy, research analyst with Macquarie, said.

He noted that net credit losses in credit cards are running at closer to 5-6%, with SBI Cards reporting 7.5% NCLs last quarter. “But they do have 50% open market customers compared to banks who have only 20%,” he added.

“The borrower’s default journey begins with making a large purchase with the idea that they will repay it in instalments. But this outstanding gets amortised at a rate as high as 48% annually, and the borrower reaches a stage where he can make only the minimum payment,” Ritesh Srivastava, founder and CEO at debt relief platform Freed, said. “What we have seen is that the borrower, to make the minimum card payment, gets into loan-stacking by taking small-ticket personal loans,” he added. According to Srivastava, credit scores do not act as guardrails because borrowers are not defaulters as long as minimum dues are being paid.

Ritesh, who was involved with a debt relief business in the US, said that the card companies are operating the same strategies as the US to scale up. Big-ticket sales are being offered at lower prices when purchased by credit cards on EMI to get big-ticket consumers.

According to a senior executive with a private bank, the EMI option provides credit at much lower rates than the roll-over rate. “There is no wilful maxing out of cards in order to default like during the global financial crisis. The delinquencies are largely in cards that are sourced from the open market because direct selling agents are incentivised to push cards,” he said.

Despite rising stress in unsecured lending, Ganapathy pointed out that RBI has been proactive. “Nothing is surprising though… the good part is our regulator was ahead of the curve,” he said. After RBI measures in Nov 2023, credit growth in unsecured segments – which also includes personal and education loans – has dropped from a peak of 25% to 15%. “So, RBI will be happy with the desired outcomes,” he said.