MUMBAI: Grocery bills are set to rise with FMCG companies planning to hike rates of household essentials like cooking oil, soaps and detergents due to higher commodity prices – like for palm oil and copra. The price revisions will keep upward pressure on inflation, which is being closely watched by RBI.

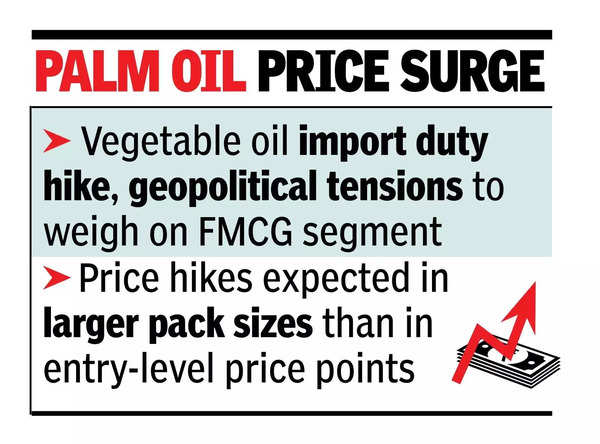

Godrej Consumer said in its Sept quarter update that its earnings will be lower due to tough operating conditions driven by increase in palm oil prices.Palm input costs, which have been rising since March, have risen in high-teens as of date. “Management has decided not to pass on the entire cost hike to consumers in one step,” the firm said. As an immediate measure, analysts expect price hikes to happen in larger pack sizes rather than at sensitive entry-level category price points.

FMCG firms’ warnings resonate with RBI’s caution over price increases in commodities. In its monetary policy statement, RBI had cautioned that unexpected weather events, worsening geopolitical conflicts (which can impact global commodity prices), and recent increases in certain commodity prices (like edible oils, wheat, and key vegetables) pose upside risks to the inflation outlook.

Marico, the maker of Saffola Oats and Parachute coconut oil, said that copra prices rose ahead of internal forecasts, and the company has already taken one round of price hikes at the end of Q2. Besides, the recent import duty hike also led to vegetable oil prices moving higher towards the end of the quarter. The company is expecting a “moderate lag” in operating profit growth in Q2 on the back of partial absorption of higher input costs and remains watchful of the potential uncertainty in crude oil prices in the wake of geopolitical tensions. Analysts tracking the sector, in fact, said that inflation will be the biggest risk for the segment in the coming quarters.

“The Israel-Iran conflict is expected to take up the prices of crude and this could affect prices of almost everything around leading to higher inflation across all commodities. Also, as more nations get involved in the conflict, it is expected that commodity supply constraints will lead to an increase in input costs for most FMCG companies,” independent consumer consultant Akshay D’souza told TOI.

The cost of tea could also be a worry for firms in Q3, analysts at Nuvama Institutional Equities said in a recent note. Tea companies have started taking gradual price hikes, analysts at the firm said.