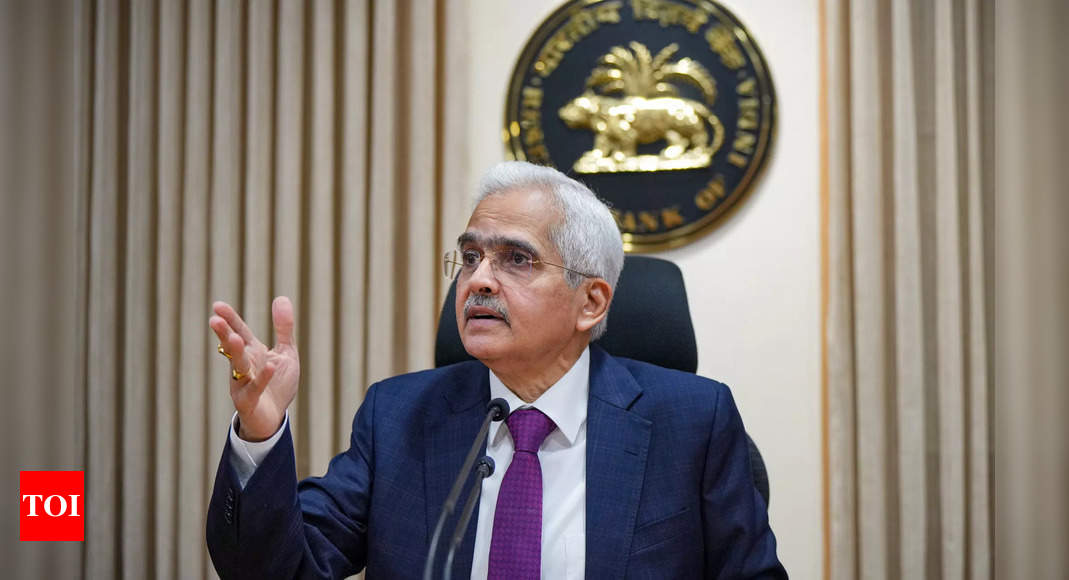

The potential growth rate refers to the rate at which the economy can grow over the long term without triggering inflation. The governor made this statement at the Bretton Woods Committee‘s annual Future of Finance Forum in Singapore, as reported by Reuters.The comments were made outside of his prepared speech, which was released.

Das said that RBI expects the economy to record 7.2% growth by the end of the year, attributing slower growth in the first quarter to low govt expenditure during the national election. In his speech, he also said that the adverse spillovers from the ‘higher for longer’ interest rate scenario remain a contingent risk. “While quite a few central banks have started treading the path of rate cuts on account of recession worries, many still continue to maintain restrictive stances and refrain from reducing policy rates so as to break the back of inflation persistence decisively,” Das said.

He added that RBI’s projections indicate that inflation is likely to ease further from 5.4% in 2023-24 to 4.5% in 2024-25 and 4.1% in 2025-26. “Inflation has moderated from its peak of 7.8% in April 2022 into the tolerance band of +/- 2% around the target of 4%, but we still have a distance to cover and cannot afford to look the other way,” Das said, adding, “The momentum of global disinflation is slowing, warranting caution in easing monetary policy.” He said that monetary policy management by central banks has to be prudent and that supply-side measures by govts have to be proactive.

According to Das, the impending monetary policy pivot in the US, with a likely soft landing, raises hopes for sustained global inflation reduction.