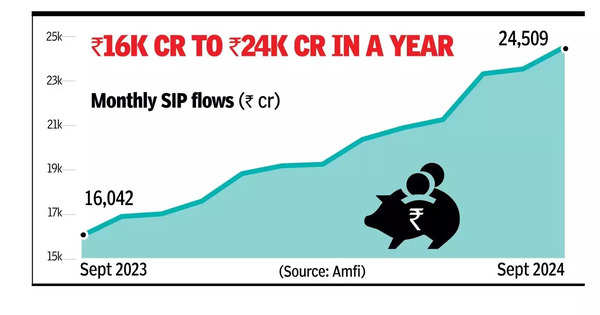

MUMBAI: Mutual fund SIPs continue to drive retail investor participation in the capital markets, with contributions crossing Rs 24,508 crore in Sept 2024 – hitting an all-time high for the 15th month in a row, data from industry body Amfi showed.

However, flows into equity mutual fund schemes dropped 10% from Aug to Rs 34,419 crore due to a slump in inflows in thematic and large-cap funds.The mutual fund industry saw an overall outflow of Rs 71,114 crore in Sept, following an investment of nearly Rs 1.1 lakh crore in Aug, largely driven by just over Rs 1.1 lakh crore withdrawals from debt schemes.

The industry’s assets under management rose to Rs 67 lakh crore by the end of Sept, up from Rs 66.7 lakh crore in Aug. Mutual fund assets are almost a third of bank deposits, which stood at Rs 215 lakh crore at the end of Sept 2024.

Retail AUM, which includes equity, hybrid, and solution-oriented schemes, also hit a record Rs 40.4 lakh crore. Mutual fund folios reached an all-time high of 21.1 crore in Sept.

Amfi chief Venkat Chalasani said, “The growing SIP contribution highlights a shift towards disciplined, long-term investment strategies.”

SIP accounts also reached a record 9.9 crore in Sept, with 66 lakh new accounts registered during the month. The SIP AUM stood at Rs 13.8 lakh crore, up from Rs 13.4 lakh crore in Aug. Liquid funds experienced significant outflows of Rs 72,666 crore in Sept, accounting for 64% of the overall outflows, followed by money market funds (Rs 23,421 crore) and overnight funds (Rs 19,363 crore).

The mutual fund industry also saw the launch of 27 new open-ended schemes in Sept, collectively raising Rs 14,575 crore, with sectoral and thematic funds accounting for 54% of the total inflows. Equity-oriented schemes recorded inflows of Rs 34,419 crore, marking the 43rd consecutive month of positive equity inflows since March 2021.

Sanjay Agarwal of CareEdge Ratings said that while equity inflows remained strong, certain categories such as ELSS and focused funds saw outflows. Debt mutual funds, meanwhile, witnessed outflows of Rs 1.1 lakh crore, typical of quarterly redemption patterns by financial institutions and corporates.

Industry experts caution that geopolitical uncertainties and concerns over valuations may temper inflows in the near term. “Iinvestors are watching global events, including China’s stimulus measures and the Fed moves,” said Deepak Ramraju of Shriram AMC.