MUMBAI/NEW DELHI: India’s biggest IPO is set to hit the floors, with markets regulator Sebi approving the draft red herring prospectus of Hyundai Motor‘s Rs 25,000-crore offer-for-sale. The IPO is expected to be launched in Oct and follows a series of public offers that have hit the markets recently.

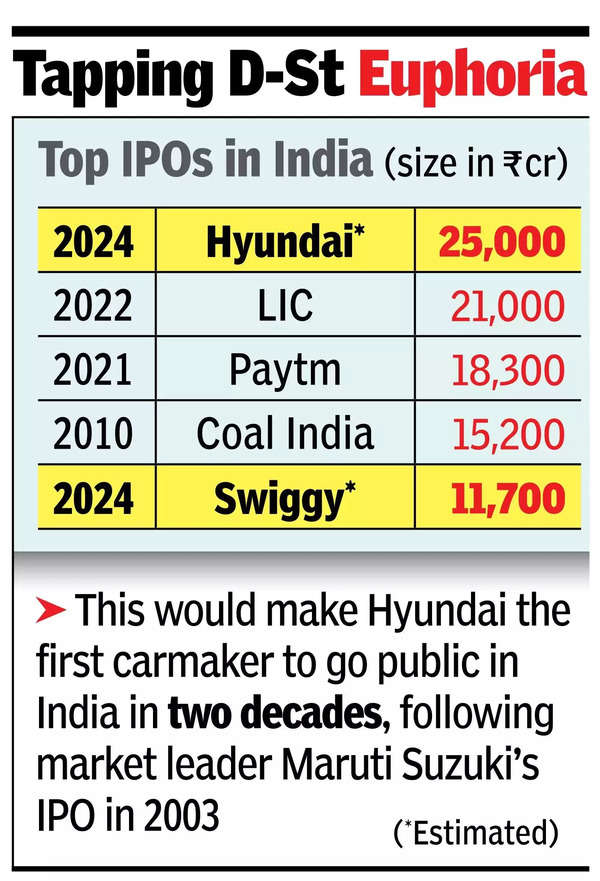

The company had filed its IPO prospectus in June this year.When launched, Hyundai’s public fund-raise will surpass the Rs 21,008-crore IPO by LIC, which had been the biggest public offer so far when it closed in May 2022. LIC’s raise was followed by the Rs 18,300-crore IPO of One97 (parent of Paytm), which hit the markets in Nov 2021, the Rs 15,199-crore offer of Coal India (Nov 2010), and Rs 11,563-crore offer of Reliance Power (Feb 2008).

The IPO for Hyundai India will be an offer for sale by Hyundai’s Korean parent, and there will be no issuance of any new shares by the company. The company is expected to dilute about 17% of its equity through the offer. The estimated $3-billion offer for a 17% stake is expected to give the company a valuation of about $18 billion, translating to about Rs 1.5 lakh crore. At present, Maruti Suzuki, the largest automaker in India, has a market cap of Rs 4 lakh crore, M&M at Rs 3.8 lakh crore, and Tata Motors is at Rs 3.6 lakh crore, BSE data showed.

Hyundai has indicated an aggressive expansion plan ahead of the planned IPO, saying it will increase its annual production in the country to one million units by 2025, with a major focus on affordable electrics that it plans to locally produce from 2025.

The company has lined up Rs 32,000 crore for investments in India, which includes funds needed to add the Maharashtra factory, acquired from GM last year, to its India production footprint.