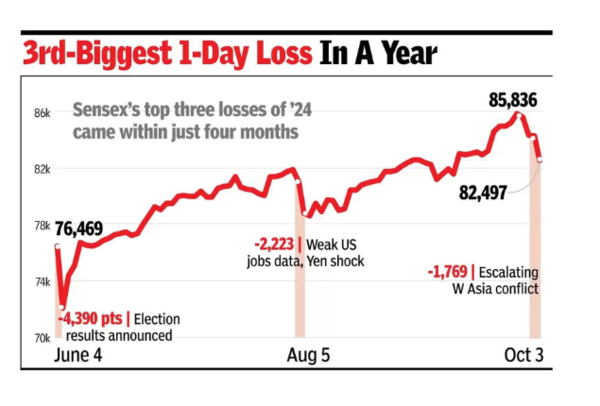

MUMBAI: The sensex plunged nearly 1,800 points on Thursday to a three-week low as the conflict in West Asia escalated. The selloff driven by oil, banking & auto stock resulted in a Rs 9.8-lakh-crore slide in investor wealth, a day after a market holiday.

The sensex closed 2.1% or 1,769 points lower at 82,497 on Thursday – its fourth straight session of decline and the biggest drop since Aug 5.The sensex dropped to 82,434 at the day’s low – an intraday drop of 1,832 points. Of the 30 sensex stocks, JSW Steel was the sole gainer as brokerage firm Nomura recommended a ‘buy’ on the stock. The broader Nifty too fell sharply, dropping 547 points (2.1%) to settle at 25,250.

Other than fears of expansion of the Iran-Israel conflict, market sentiment was weak because GST collections recorded their lowest growth rate in 40 months. Foreign institutional investors redirected funds to China, impacting Indian equities. Jefferies reduced India’s weightage and increased China’s, signalling a shift in foreign investment priorities. There were also concerns that Sebi’s restrictions on the F&O segment announced on Monday hurt volumes.

Public sector oil companies fell by 4-6% over fears that the conflict would impact the flow of crude oil with Iran launching missiles at Israel. Among the sensex scrips, L&T – which has West Asia as its largest market besides India – fell over 4% too. Asian Paints and Reliance Industries fell on fears that the rise in oil prices would put pressure on margins. Shares of tea companies dropped over 10% as tea is the second-largest export item, after rice, to Iran under the food-for-oil trade.

“There was carnage on Dalal Street as markets plunged on across-the-board selling pressure on twin concerns of foreign funds pulling out funds from emerging markets including India and steadily increasing exposure to Chinese markets after the recent stimulus measures, while escalating tensions in West Asia, too, set alarm bells amongst investors,” Prashant Tapse of Mehta Equities said. He added that Q2 earnings announcements are expected to set the tone for the market.

The broader market reflected similar weakness, with the BSE midcap index falling nearly 2.3% and the smallcap index declining 1.8%. All sectoral indices on the BSE ended in the red. Rising crude oil prices – which have surged nearly 5% in three days – are impacting industries dependent on petroleum-based raw materials, including paint and tyre companies. Shares of Berger Paints and Asian Paints fell by 6% and 4.4%, respectively, as oil price pressures increased production costs, squeezing profit margins. Shares of Indian companies with exposure to Israel – including Adani Ports, Sun Pharma, and Dr Reddy’s Labs – were under investor scrutiny. Adani Ports, which owns the Haifa Port in Israel, fell 2.5%, while Sun Pharma’s shares traded flat despite the ongoing conflict.

Meanwhile, Sebi’s new regulations for F&O trading could limit retail participation in the derivatives segment, impacting listed brokerages reliant on these trades.